Not that long ago, if you brought up environmental, social, and governance (ESG) in a boardroom, you’d be met with blank stares or eye rolls. Today, not so much. In fact, the number of manufacturers shouting out their sustainability efforts from the rooftops has grown at breakneck speeds.

This is a good thing, but the rise of corporate sustainability management has triggered an explosion in new ESG buzzwords. Wading through all the jargon can slow you down from reaching your sustainability goals. Worse yet, over-investing in a project based on how buzz-worthy it is can lead you down the wrong rabbit hole.

We asked our team of supply chain sustainability experts for their hot takes on the most misleading and confusing ESG buzzwords. Here’s what they had to say.

ESG Certification & ESG Rating

Boiling down a complex topic like ESG performance into simple, universal scorecards is the utopian Shangri-La that investors, regulators, and board members are searching for. But the industry is nowhere nearer to agreeing on a global ESG rating system than we are to getting the flying cars promised in the Jetsons.

“Ask any two people what the definition of ESG is and you’ll get three answers. One agency wants to rate an organization’s commitments while another wants to evaluate performance. Then, to make it more confusing, a financial institution may combine those into their own score to give some investments an ESG accreditation. Fundamentally, everyone involved in the rating process is coming from the right frame of mind, but there’s no standardization in place between players.” —Jared Connors, Director, Sustainability at Assent

Because ESG ratings don’t comprehensively adhere to any specific sustainability regulation, and aren’t typically endorsed by any government agency, they can’t be used to replace due diligence requirements for sustainability regulations like the EU Corporate Sustainability Reporting Directive (CSRD).

That doesn’t mean you shouldn’t take advantage of ESG ratings when it makes sense for your business goals. But it does mean you should get clarity from your stakeholders about why you need a rating or certain score level, and what they want to accomplish with it.

Scope 3 (Emissions)

Measuring your carbon footprint might just be the most complex thing you’ll ever do in your sustainability program. It has all the fun of advanced algebra, except the data you need is locked in some utility bills and fuel consumption records somewhere several tiers deep in your supply chain. There’s a reason why most companies only calculate scope 1 and 2 emissions, unless they absolutely have to report scope 3.

So what makes scope 3 a more confusing ESG term than scope 1 or 2?

The real problem when someone says “scope 3” is that its people often use it as shorthand for supply chain emissions. Although scope 3 does include the supply chain, the formal definition extends beyond just that.

In reality, scope 3 covers all the associated emissions outside your operational boundaries. There are actually 15 categories of scope 3 emissions, at least according to the Greenhouse Gas Protocol Scope 3 Standard.

Scope 3 is less about the supply chain and more about the total value chain of your products and operations. That includes emissions like those related to the disposal of your products after you’ve sold them. To quote Mufasa from the classic animated film turned Broadway sensation, The Lion King: “Everything the light touches is our kingdom.” Meaning anything your products touch upstream and downstream fall into your scope 3 emissions.

And if those words of wisdom from a fictional lion didn’t clear things up for you, here’s what our supply chain ESG expert Devin O’Herron had to say about scope 3:

“Scope 3 emissions, by definition, are literally a catch-all for related emissions not covered under scope 1 and 2. They’ve historically been deprioritized because they are inherently complicated. But regulators now recognize that ignoring them omits a huge element of your ESG impact. New market drivers are challenging manufacturers to roll up their sleeves and look at the supply chain and beyond.” —Devin O’Herron, Regulatory & Sustainability Expert, ESG & Responsible Sourcing

Conformant Smelters

Section 1502 of the Dodd-Frank Act requires companies to disclose if they’re sourcing minerals from the Democratic Republic of the Congo (DRC) or other conflict-affected areas. Conflict minerals compliance boils down to being able to point out the country of origin of your minerals on a map.

But in reality, mineral supply chains aren’t so simple to manage. After miners have extracted the minerals from the earth, there are many hands responsible for processing and delivering them to your doorstep. This makes visibility into mineral sourcing difficult.

Smelters play an important role in this process. In fact, they’re the pinch point of mineral sourcing data, the gatekeepers into the deeper tiers of your supply chain. They’re purchasing and refining minerals from a number of mines and recycling sources. Smelters are so pivotal that the minerals industry created a voluntary auditing framework, the Conformant Smelters Program.

And here’s where people get confused:

Conflict minerals legislation centers around country of origin and chain of custody validation. While all materials flow through smelters and refiners, due diligence on these entities isn’t the only method to meet your requirements. Many EU regulations also focus on the country of origin and chain of custody rather than smelters. Yet people still build programs solely around smelter conformance and ignore country of origin due diligence. While having insights into smelter risks is important, conformance or non-conformance doesn’t answer the country of origin question.

It’s important not to confuse participation in the Conformant Smelters Program with being compliant with conflict mineral requirements. Because it’s a voluntary and paid process, there are a number of low-risk smelters that are labeled “non-conformant” due to non-participation or because they operate in a geography that gives downstream companies cause for concern even if they don’t have actual non-compliance risks. So if you’re attempting to drop smelters from your supply chain based solely on conformance status without conducting further due diligence, you’re only shooting yourself in the foot. You don’t want to be a one-trick pony when it comes to responsible sourcing.

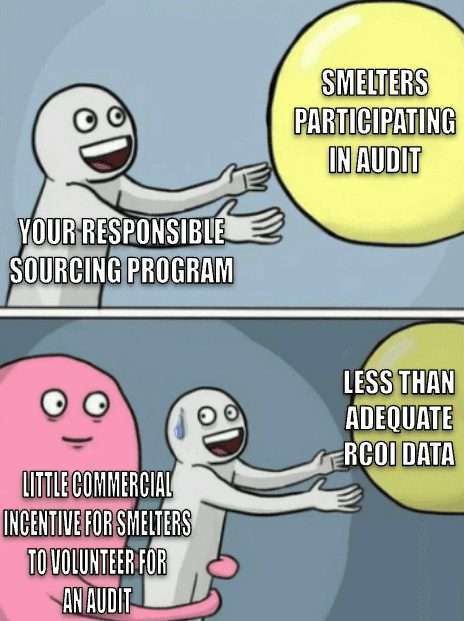

“Many companies use smelter conformance as a crutch to say that they have conducted their supply chain due diligence and wash their hands of actual supply chain engagement. But Assent has seen many smelters who opt out because it costs thousands of dollars and there’s not enough incentive for them to participate in a program that benefits an entity that is sometimes eight tiers removed from them.” —Noah Taetle, Regulatory & Sustainability Analyst, ESG & Responsible Sourcing at Assent

Working with conformant smelters is a good thing, but it’s only one piece of the puzzle. You also need due diligence for country of origin data, along with visibility into the forced labor risks and any connections to sanctioned entities and individuals in your full mineral supply chain.

Get Clarity on Your ESG Priorities

We’ve only scratched the surface here when it comes to confusing ESG buzzwords — we’d need an entire book to cover them all. Understanding sustainability management is complicated enough without having to decode terminology. And when the market matures in greenhouse gas (GHG) reporting, the next hot topic (like waste management or natural resources procurement) will take center stage, ensuring there are always more ESG terms to keep up with.

But Assent makes it simpler to know what’s material to your sustainability goals and measure your suppliers’ ESG performance. Our supply chain sustainability management solution gives you visibility into ESG risks and automates supplier outreach on key topics like forced labor, responsible mineral sourcing, and embedded carbon emissions.

Check out Four Steps to Creating an ESG Program for Manufacturers, Assent’s quick-start guide for expert guidance on setting achievable ESG goals and collecting sustainability data from your supply chain.